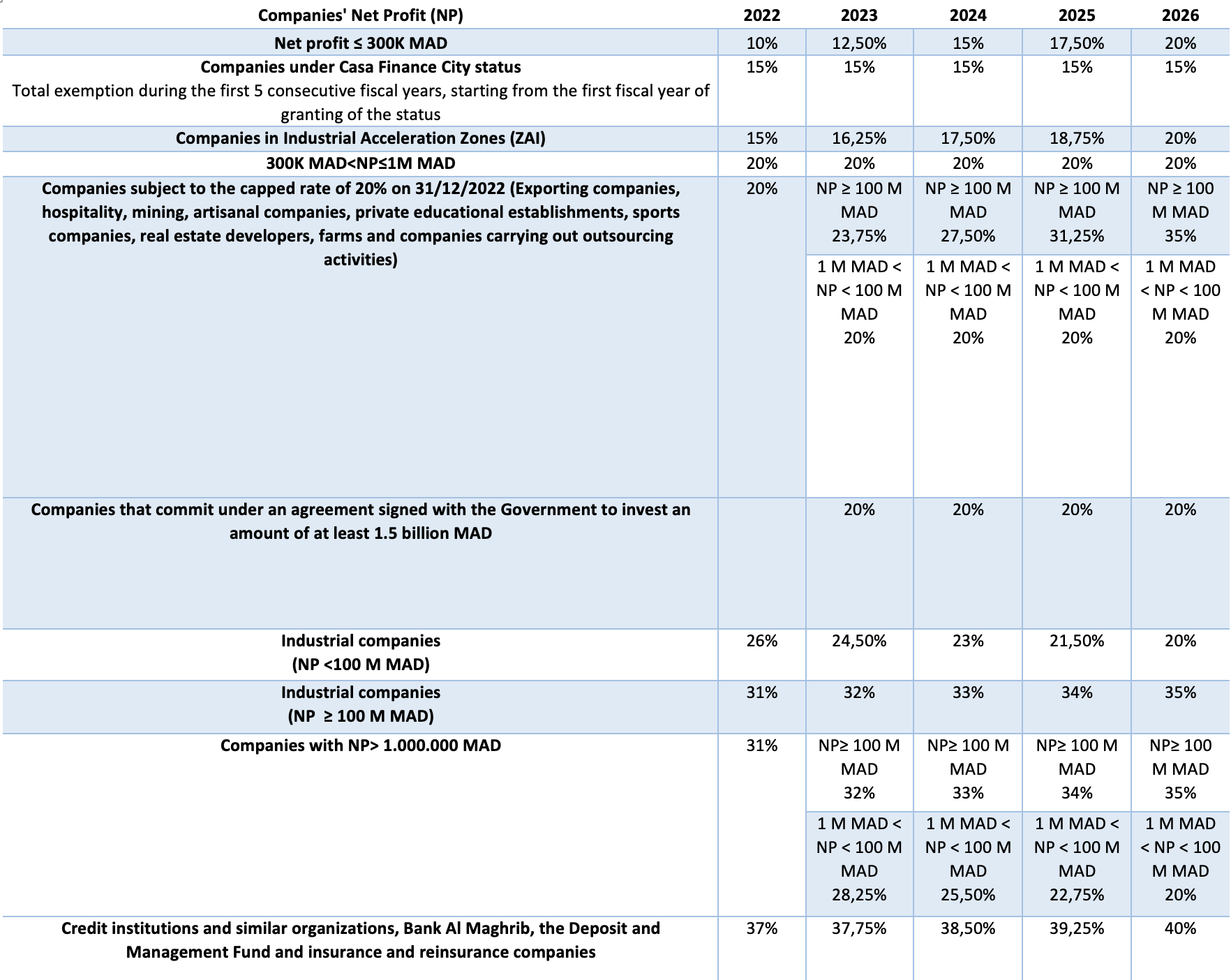

The 2023 Finance Law expects an economic growth rate of 4.5% in 2023, after growth estimated at 1.5% in 2022. At the same time, the focus is on the flagship projects that the Government intends to launch or continue this year, particularly in terms of investment and the improvement of the business climate in Morocco.

In essence, the 2023 Finance Law announces, among others, the adoption and implementation of the provisions of the new framework law forming the investment charter with increased facilities provided for foreign investments, the continuation of public investment effort, in particular through the deployment of the Mohammed VI Fund for Investment, the acceleration of projects relating to the reform of the administration and the improvement of the business climate, as well as the launch of the national digital strategy and the promotion of the national products through the encouragement of the competitiveness of the label “Made in Morocco”.

The 2023 Finance Law is a response to these new measures, and it breaks down as follows:

Please feel free to contact us at contact @ arkadplus.com for more information on how we can be your partner for feasibility studies, bookkeeping as well as the support for a convention with the Moroccan Government for the investment incentives.