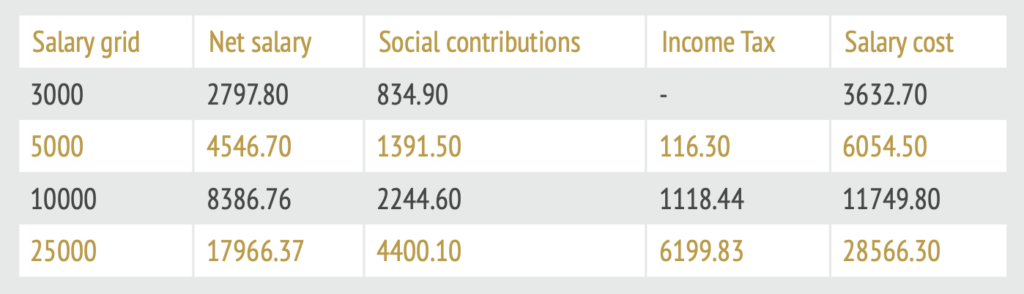

The most basic employee costs in Morocco are fees such as social security, income tax (paid for by the employer), and employer contribution.

They break down as follows:

However, thanks to the 2023 Finance Law, the company can benefit from a total exemption from income tax and a partial exemption on social security contributions through various programs offered by Morocco for the encouragement of investment and recruitment. The details of the exemption break down as follows:

- Extension of the income tax exemption period for newly recruited employees until December 31, 2026

As part of the measures to encourage and support employment and improve the competitiveness of companies, the 2023 Finance Law extended the period of application of the exemption from income tax under the gross monthly salary capped at 10,000 dirhams paid by a company, association or cooperative created during the period from January 1, 2015 to December 31, 2026, and within the limit of 10 employees.

This benefit is granted for a period of 24 months from the date of recruitment of the employee, subject to compliance with the following conditions:

- The employee must be recruited under a permanent employment contract;

- The recruitment must be carried out within the first two years from the date of the start of operation of the business, association or cooperative.

- Extension of the period of exemption from income tax relating to salaries paid to the employee on the occasion of their first recruitment until December 31, 2026, regardless of the date of creation of the company:

As part of the pursuit of actions aimed at encouraging the integration into working life of young people who have not yet held a job, the Finance Law for the year 2023 has extended the duration of application of the exemption in terms of income tax (IR) of the salary paid by a company, association or cooperative, whatever the date of its creation, to an employee on the occasion of their first recruitment, and this, during the thirty-six (36) first months from the date of said recruitment.

This advantage is granted under the following conditions:

- The employee must be recruited under a permanent employment contract, concluded during the period from January 1, 2021 to December 31, 2026;

- The age of the employee must not exceed 35 years on the date of the conclusion of their first employment contract.